Wealth Management Solutions

Retirement Annuities,

Collective Investments,

Endowment Plan,

Education Plan,

Managed Portfolios,

Linked Products,

Life Annuities,

Joint Life Annuities,

Capital Retention Plan,

Pension with Capital Repayment,

Investment linked Life Annuity,

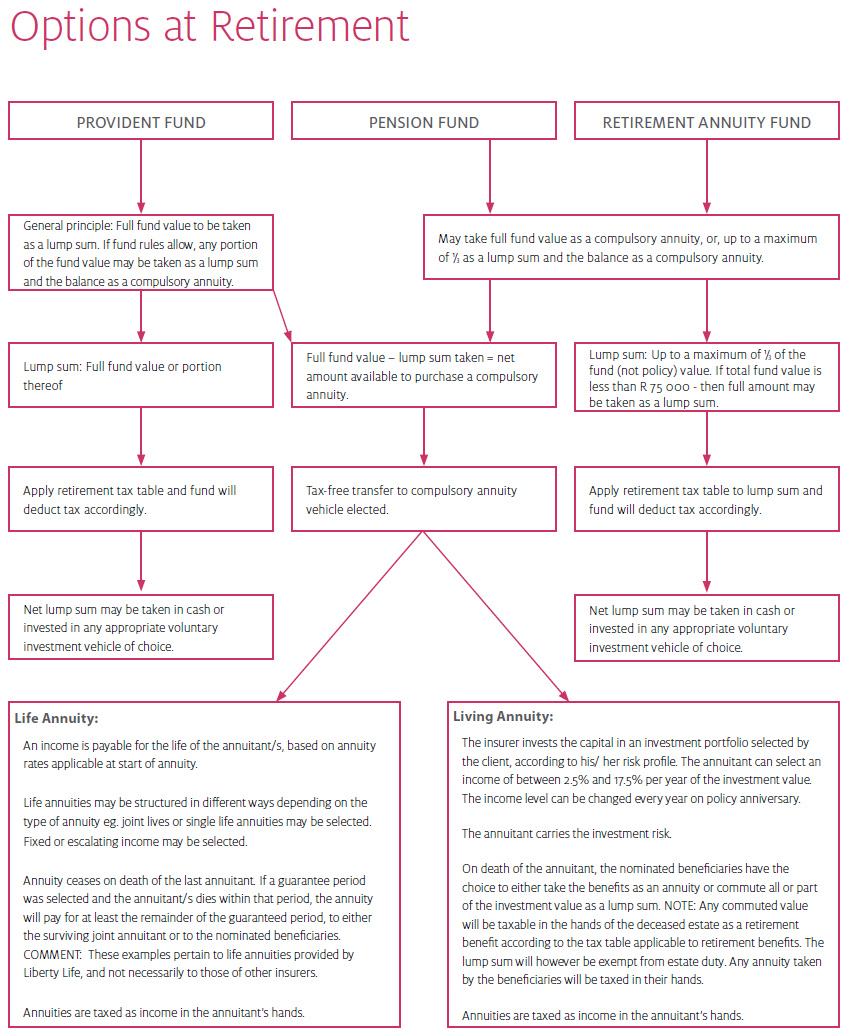

Options at Retirement.

Summary Investment Products

An Individual becomes a member of a retirement annuity fund. The fund either takes out a plan with a life insurer on the life of the member or an investment plan with a linked product provider for the sole benefit of the member, to fund its liabilities to the member. The member may contribute his/her own money or transfer money from another fund. Proceeds may only be taken from the 55th birthday but before the 70th birthday. A maximum of one-third may be taken as a lump sum whilst the remaining portion must be used to purchase a compulsory pension.

Why choose it?

Contributions to the fund are tax deductible up to certain limits. There is currently no tax payable on returns within the fund, including capital gains tax. A portion of the lump sum is tax free up to a certain limit, with the remainder of the lump sum taxable on a tax friendly sliding scale. A retirement annuity is protected against claims from creditors.

You buy units in a collective investment fund. You can sell your units any time you wish to.

Why choose it?

Your money is always accessible. As with investment plans, highly qualified investment managers look after your money. A cost-effective way of investing with professionals.

You contract with an Insurance Company to invest your money in a plan over a term. This type of contract pays you an amount at the end of the contracted term which could be extended on your request.

Why choose it?

The plan can be used as collateral against loans. During the first 5 years, legislation allows you to access your money through one loan and one partial cash withdrawal. No restrictions on accessing your cash after 5 years. Limited protection at insolvency. Option to invest offshore. Option to select investment funds offering guarantees.

You contract with an Insurance Company to invest your money in a plan over a term. This type of contract pays you an amount at the end of the contracted term to use for your child’s education.

Why choose it?

You ensure that there will be funds available for your child’s education. During the first 5 years, legislation allows you access to your money through one loan and one partial cash withdrawal. No restrictions on accessing your cash after 5 years. Limited protection at insolvency. Option to invest offshore. Option to select investment funds offering guarantees.

Together with a professional fund manager you manage your own stock portfolio and make investment decisions according to your very specific needs.

Why choose it?

Puts you in the driver’s seat, giving you a big say in the actual investment decision.

An investment that gives you access to unit trusts from a number of different unit trust manager companies.

Why choose it?

Manage a single portfolio across a number of different unit trust manager companies. Regular feedback on your investments. Easy to manage your money more efficiently and maximise growth. Option to invest offshore. Option to select investment funds offering guarantees.

Receive a guaranteed pension (which is not affected by declining interest rates) until your death. The guaranteed term you select will impact on the level of pension you receive.

Why choose it?

You can choose guaranteed levels of income, regardless of what happens on the stock market or capital markets. You can choose a guaranteed term and if you die during the guaranteed term, the pension is still payable to your dependants until the end of the guaranteed term.

Designed for one spouse to receive the income and on his/her death for the other spouse or common-law partner to receive the income. A guaranteed income is payable until the last person in the relationship dies.

Why choose it?

You can choose guaranteed levels of income, regardless of what happens on the stock market or capital markets. You can choose a guaranteed term and if you die during the guaranteed term, the pension is still payable to your dependants until the end of the guaranteed term.

Receive a guaranteed pension until your death. At death your original capital is preserved and paid to your estate or beneficiaries.

Why choose it?

You can choose guaranteed levels of income, regardless of what happens on the stock market or capital markets. You can choose the term for which your capital must be fully guaranteed.

Pension with Capital Repayment

Receive a guaranteed pension until your death or, if you choose, the death of the surviving spouse. After death the pension ceases and an amount equal to the original capital is paid to your beneficiary in 60 monthly installments.

Why choose it?

You can choose guaranteed levels of income, regardless of what happens on the stock market or capital markets. You can choose that either your spouse or common-law partner receive the income after your death.

Investment linked Life Annuity

Your capital is invested in a diversified portfolio investment and unit trust funds. Your capital growth will depend on the level of income selected and the underlying investment performance. The remaining capital is available to your dependants after your death to receive an income.

Why choose it?

You can choose market-based pension plans with the potential of additional capital growth, but with increased risk. You can choose the level of income which you want to receive between 2.5% and 17.5% of the capital amount and review it annually.

Note: The summary of investment products pertain to some investment products provided by Sanlam and not necessarily to those of other insurers.

Any product information [legal and / or technical] on this webpage is subject to change from time to time. This webpage is a summary of some financial products / different product features and is not to be construed as advice by Procon Insurance Brokers. Any recommendations made must take into consideration your specific needs and personal circumstances.Procon. Pretoria

Enige produk inligting [wetlik en / of tegnies] op hierdie webblad is van tyd tot tyd aan verandering onderhewig. Hierdie webblad is ’n opsomming van sommige finansiële produkte / verskeie produkte se kenmerke en moet nie as advies deur Procon Versekeringsmakelaars beskou word nie. Enige aanbevelings wat gemaak word, moet jou spesifieke behoeftes en persoonlike omstandighede in ag neem.Procon. Pretoria